This ICCT report explores the untapped potential of Brazilian ports in becoming key hubs for renewable marine fuel bunkering. With a focus on renewable hydrogen, ammonia, and methanol, the study evaluates Brazil’s infrastructure, strategic positioning, and capacity to support the global shipping sector’s transition to cleaner fuels.

Brazil, with its abundance of renewable energy resources and its strategic geographical positioning, has the potential to play a central role in the global transition to cleaner marine fuels. According to a comprehensive report “The potential of Brazilian ports as renewable marine fuel bunkering hubs” released by the International Council on Clean Transportation (ICCT).

Brazilian ports could become major hubs for renewable marine fuels like renewable hydrogen (RE-H2), renewable ammonia (RE-NH3), and renewable methanol (RE-MeOH). This shift could revolutionize maritime shipping, accelerating decarbonization and facilitating the establishment of green shipping corridors on major trade routes.

The study explores the feasibility of utilizing Brazil’s ports to support the production, bunkering, and distribution of these renewable fuels, particularly focusing on hydrogen and its derivatives. This would provide a crucial infrastructure for international shipping routes, ultimately reducing the carbon footprint of the global shipping industry.

Table of Contents

Key Findings of the Study

1. Identification of Six Candidate Ports for Renewable Marine Fuel Bunkering

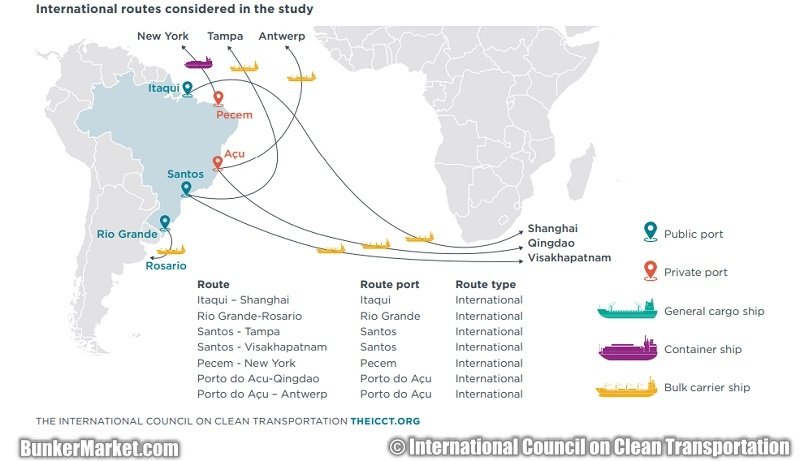

The study identifies six Brazilian ports—three public and three private—that show strong potential to serve as renewable marine fuel bunkering hubs:

- Public Ports:

- Santos: The largest port in Latin America, which excels in infrastructure, strategic location, and connectivity.

- Rio Grande: A port with significant growth potential, ideal for integration with renewable energy sources.

- Itaqui: A port positioned strategically to support renewable fuel bunkering operations.

- Private Ports:

- Porto do Açu: A privately-operated port with a focus on energy infrastructure and renewable initiatives.

- Pecém: A growing port well-connected to industrial clusters and major trade routes.

- Navegantes: A port benefiting from well-established shipping lanes and potential for green fuel integration.

While private ports generally scored lower in terms of connectivity to energy infrastructure, public ports—especially Santos—demonstrated robust performance in nearly all evaluation criteria.

2. High Port Readiness for Renewable Fuel Integration

The study evaluated each port’s readiness on a scale of 1 to 5 across five key criteria: infrastructure, strategic location, connectivity, potential for renewable energy integration, and accessibility to shipping routes.

- Santos, Latin America’s largest port, received a strong score across the board, particularly in infrastructure and connectivity.

- Porto do Açu and Itaqui scored well, though they showed gaps in offshore wind energy potential, an essential aspect for green fuel production.

Overall, all six ports scored between 3.5 and 4.4, indicating a solid foundation for implementing renewable fuel bunkering operations.

3. Feasibility of Renewable Fuel Usage on Key Shipping Routes

The report analyzed 10 sample trade routes, including domestic and international routes linking the identified ports. The analysis concluded that five of these routes could be fully completed using renewable liquid hydrogen (RE-LH2) in fuel cells, with no need for refueling during the journey.

Additionally, all routes were deemed feasible for vessels using renewable ammonia (RE-NH3) and renewable methanol (RE-MeOH) in internal combustion engines, which could eliminate the need for refueling mid-route. This demonstrates that renewable fuels could meet the energy demands of major shipping routes connecting Brazil to both local and global markets.

4. Estimated Fuel and Energy Demand for Zero-Emission Shipping

To achieve zero-emission shipping on these routes, an estimated 1,785 to 1,911 tonnes of renewable hydrogen would be needed. This would correspond to a renewable electricity demand of 82 to 92 GWh annually.

For context:

- This is approximately 0.1% of the annual output of Itaipu, Brazil’s largest hydroelectric power plant.

- It represents roughly 0.2% of Brazil’s planned renewable hydrogen production in the coming years.

This relatively small proportion of the country’s energy production demonstrates that Brazil’s energy infrastructure is more than capable of supporting the production and distribution of renewable fuels for maritime shipping on a large scale.

5. Current Ship Traffic Emissions and Potential Impact

In 2023 alone, vessels operating on the sample routes were estimated to have consumed 4,449 tonnes of fuel and emitted approximately 13,862 tonnes of CO₂ per trip. This highlights the significant opportunity for reducing emissions through the deployment of zero-emission vessels along these routes.

The study also noted the varied operational efficiency across different routes, which suggests the possibility of prioritizing the most efficient routes for the initial deployment of zero-emission ships. Such a strategy would yield immediate environmental and economic benefits by reducing carbon emissions and operational costs.

Conclusion: Economic and Environmental Benefits of Renewable Marine Fuel Bunkering

This pre-feasibility study highlights the enormous potential for Brazilian ports to become key players in the global green shipping transition. The combination of Brazil’s renewable energy resources and the strategic positioning of its ports provides a unique opportunity for the country to establish itself as a global leader in renewable marine fuel bunkering.

By developing the infrastructure to support renewable hydrogen and its derivatives, Brazil could reduce global shipping emissions, contribute to the creation of green shipping corridors, and strengthen its position as a global energy hub.

The study provides a clear roadmap for policymakers, industry leaders, and investors interested in supporting the decarbonization of global shipping. The data gathered on port readiness and renewable fuel demand serves as an essential guideline for shaping future investments and strategies aimed at realizing a sustainable and clean maritime future.

For more information, you can download the full report from the International Council on Clean Transportation website – Click Here ICCT

About the ICCT

The International Council on Clean Transportation (ICCT) is an independent, nonprofit organization committed to providing high-quality, unbiased research to environmental regulators across the world. The ICCT works to improve the environmental performance and energy efficiency of transportation sectors, including road, marine, and air transportation, in order to mitigate climate change and improve public health globally.