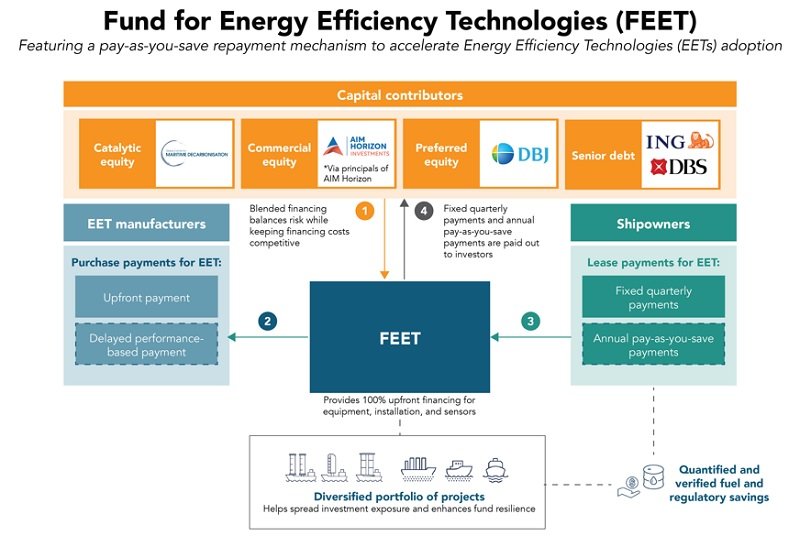

Singapore | November 20, 2025 – The Global Centre for Maritime Decarbonisation (GCMD), alongside AIM Horizon Investments and a powerful consortium of financial partners, has announced the successful closure of the Fund for Energy Efficiency Technologies (FEET). The fund secured total commitments of up to USD $35 million, exceeding its initial target, and marks a paradigm shift in how vessel energy efficiency retrofits (EETs) are financed globally.

FEET is distinguished as the world’s first fund for vessel retrofits to leverage a pay-as-you-save repayment mechanism, directly tackling the historical financial uncertainties that have slowed the adoption of crucial decarbonisation technologies in the shipping sector.

Table of Contents

FEET: Decoupling Financing from Vessel Mortgages

The core innovation of FEET lies in its ability to offer an unsecured financing solution, thereby decoupling retrofit financing from the vessel’s existing mortgage structure—a major bottleneck for shipowners.

Key Features of the FEET Fund:

- Up to 100% Upfront Financing: FEET provides full financing for the equipment, installation, and sensorisation costs associated with retrofits.

- Pay-as-You-Save Repayment: Repayment is directly linked to quantified and verified fuel and regulatory savings, eliminating payback uncertainty for the shipowner.

- Unsecured Leases: By offering unsecured leases, FEET avoids complex renegotiations with existing secured financiers, accelerating EET uptake.

- Ownership Transfer: At the end of the lease term, the ownership of the EET is transferred to the shipowner for a nominal fee.

GCMD provides catalytic equity and serves as FEET’s appointed decarbonisation advisor, ensuring that the projects align with rigorous performance and sustainability standards.

A Blended Financing Structure Drives Resilience

FEET is managed by AIM Horizon Investments, a Singapore-based fund manager specialising in maritime and aviation funds. The fund has attracted a robust blend of capital, designed to balance financial risk while maintaining competitive financing costs.

- Commercial Equity: Held by shareholders of AIM Horizon Investments.

- Preferred Equity: Held by the Development Bank of Japan Inc. (DBJ).

- Senior Debt Financing: In principle agreement secured from DBS Bank and ING (which also acted as Coordinating Bank).

- Catalytic Capital: Provided by GCMD.

This diversification across various technologies, manufacturers, vessel owners, and vessel types spreads investment exposure and significantly enhances the fund’s resilience.

Addressing the $20B Retrofit Market’s Pain Points

Improving energy efficiency through EETs—such as Wind-Assisted Propulsion Systems (WAPS) and Air Lubrication Systems (ALS)—is crucial for immediate fuel cost reduction and maintaining competitiveness under tightening regional carbon regulations.

However, the over USD $20 billion retrofit market has historically been hampered by two main issues:

- Variable Fuel Savings: Savings are inherently dependent on operational and environmental factors (e.g., routing and weather), making the Return on Investment (ROI) period difficult to predict.

- Split-Incentive Issue: Shipowners are expected to invest in retrofits, while charterers often realise the immediate fuel savings.

FEET’s pay-as-you-save model is a direct solution, requiring robust data collection and analysis—an area where GCMD has been active through its EET performance pilots—to isolate and verify the retrofit’s specific contribution to fuel savings with statistical confidence.

Poised for Massive Scale and Industry Impact

The initial closing is just the first step. GCMD and AIM Horizon Investments have an ambitious target to scale FEET to USD $500 million by 2030. This scale would be capable of supporting retrofits on approximately 200 ships.

Professor Lynn Loo, CEO, GCMD, said: “Bringing FEET to life has taken persistence and a willingness from everyone involved to step into the unknown. There was no playbook; our teams were learning as we went. This is exactly the kind of collaborative, problem-solving mindset needed to move the needle on maritime decarbonisation.”

Several projects have already been identified and progressed to the final investment decision stage, reflecting strong and immediate industry confidence.

Voices from the Partnership

Michiel Muller, Partner AIM Horizon & FPG AIM, highlighted the collective effort: “We are proud to work in this partnership and bring an innovative financial product for maritime decarbonisation. It has taken a huge collective effort to create a solution that immediately reduces carbon emissions and has competitive economics that will enable it to really scale.”

Stephen Fewster, Global Head of Shipping, ING, affirmed the commitment: “We are therefore delighted and honoured to have collaborated with GCMD and our partners to drive the adoption of energy efficiency retrofits which are key for shipping’s decarbonisation. We look forward to further cooperation and scaling this innovative solution.”

Max Lim, Managing Director and Group Head, Shipping, Aviation, Logistics & Transportation, DBS, stressed the opportunity: “The FEET initiative not only supports the adoption of technologies for energy efficiency, but also seeks to help shipowners manage financial and climate risks. DBS is proud to be a partner in this pioneering effort.”

Corporate Finance Department, Division 4, DBJ, said: “We believe that the adoption of EETs is an effective solution for maritime decarbonisation. FEET provides a platform to support this, and DBJ has decided to invest in the fund. We are proud to be involved in such an international and ambitious initiative, and we sincerely hope that FEET’s efforts will expand and contribute to the decarbonisation of the maritime industry.”

EET Technology Spotlight: WAPS and ALS

The Fund for Energy Efficiency Technologies (FEET) is designed to accelerate the adoption of proven Energy Efficiency Technologies (EETs) that deliver immediate fuel and emissions savings. The primary technologies FEET will finance include:

1. Wind-Assisted Propulsion Systems (WAPS)

WAPS technologies harness the natural power of wind to supplement a vessel’s main engine, generating aerodynamic forces to propel the ship. This reduces the engine load, resulting in significant fuel savings and emission reductions (often cited in the range of 5% to over 25%, depending on the system and vessel type).

- Key WAPS Types: These systems are an evolution of traditional sails, incorporating modern materials, automation, and intelligent controls. Common technologies include Flettner Rotors (spinning cylinders that use the Magnus effect to create thrust), Rigid Wing Sails, and Kite Sails.

- Decarbonisation Role: WAPS are considered a crucial “energy harvesting” technology, utilizing a free, inexhaustible, and zero-carbon energy source to help shipowners comply with tightening regulations like EEXI and CII.

2. Air Lubrication Systems (ALS)

ALS is a highly effective method for reducing a vessel’s frictional resistance, which can account for a significant portion of a ship’s total drag, especially for slower-moving vessels.

- Mechanism: ALS works by generating a continuous layer of microbubbles along the flat bottom of the ship’s hull. Air compressors supply air to dedicated release units (ARUs) on the hull.

- Efficiency Gain: The cushion of air reduces the contact between the hull and the seawater, lowering the wall shear stress and frictional drag. Operational data indicates average fuel savings typically ranging from 5% to 15%, depending on the hull design, speed, and sea state.

- Other Benefits: In addition to fuel savings, ALS can also contribute to the reduction of underwater radiated noise and may help in mitigating bio-fouling growth.

About AIM Horizon Investments

AIM Horizon Investments (formerly known as FPG AIM Capital) is a Singapore-based, licensed asset manager focused on private investments in the maritime and aviation sectors. The firm is led by an experienced team with over 80 years of collective expertise in fund management and transportation finance.

- Affiliations: Affiliated with FPG AIM, which since 2012 has directly sourced and structured more than US$23 billion of shipping, container, and aircraft transactions.

- Presence: The group operates from key transportation hubs across Asia, EMEA, and the Americas.

About Development Bank of Japan Inc. (DBJ)

DBJ is a wholly government-owned financial institution in Japan, and its corporate mission is “Applying financial expertise to design the future.” Its ship finance team has extensive experience in the maritime industry, serving both Japanese and international clients. One of the team’s recent areas of focus is supporting maritime decarbonisation through financial solutions.

About ING

ING is a global financial institution with a strong European base, offering banking services through its operating company ING Bank. The purpose of ING Bank is: empowering people to stay a step ahead in life and in business.

- Sustainability Commitment: ING aims to put sustainability at the heart of its operations.

- ESG Ratings (as of 2024/2023): MSCI ‘AA’ (reconfirmed Aug 2024), Sustainalytics ESG Risk Rating of 17.2 (Low Risk).

- Stock Listings: Listed on the exchanges of Amsterdam (INGA NA, INGA.AS), Brussels, and on the New York Stock Exchange (ADRs: ING US, ING.N).

About DBS

DBS is a leading financial services group in Asia with a presence in 19 markets. Headquartered and listed in Singapore, DBS is in the three key Asian axes of growth: Greater China, Southeast Asia and South Asia.

- Credit Ratings: The bank’s “AA-” and “Aa1” credit ratings are among the highest in the world.

- Global Recognition: Recognised as “World’s Best Bank” by Global Finance and Euromoney, and “Global Bank of the Year” by The Banker.

- Focus: Provides a full range of services in consumer, SME and corporate banking, with a commitment to leveraging digital technology.

- DBS Foundation: Creates impact beyond banking by uplifting lives and livelihoods, and nurturing innovative social enterprises.

About the Global Centre for Maritime Decarbonisation – GCMD

The Global Centre for Maritime Decarbonisation (GCMD) was established as a non-profit organisation on 1 August 2021 with a mission to support the decarbonisation of the maritime industry by shaping standards, deploying solutions, financing projects, and fostering collaboration across sectors.

- Founders: BHP, BW Group, Eastern Pacific Shipping, Foundation Det Norske Veritas, Ocean Network Express and Seatrium.

- Funding: GCMD receives funding from the Maritime and Port Authority of Singapore (MPA) for qualifying research and development programmes and projects.

- Strategic Partners: bp, Hanwha Ocean, Hapag-Lloyd, NYK Line and PSA International have joined as Strategic partners.

- Initiatives: GCMD has launched key initiatives to close technical and operational gaps in: deploying ammonia as a marine fuel, developing an assurance framework for drop-in green fuels, unlocking the carbon value chain, and closing the data-financing gap for energy efficiency technologies.

- Location: Strategically located in Singapore, the world’s largest bunkering hub and busiest transshipment port.